tax on venmo cash app

Squares Cash App includes a partially updated page for users. The Bottom Line On Zelle PayPal Venmo Taxes.

Getting Paid On Venmo Or Cash App There S A Tax For That Los Angeles Times

I do part time babysitting and I get paid through Venmo or Cashapp for that.

. How the new cash app regulations work. New Cash App Tax Reporting for Payments 600 or more. If you filed with Credit Karma Tax before we can help you get your past tax returns.

4 that it will send 1099s just to users enrolled in its Cash App for Business program. Currently cash apps are required to send you 1099 forms for transactions on cash apps that exceed a total gross payment of 20000. Venmo is a digital wallet that makes money easier for everyone from students to small businesses.

Even with the tax changes third-party payment apps such as Venmo Cash App and PayPal are still convenient and affordable ways to send and receive money. The P2P peer-to-peer payment apps have soared in popularity in recent years. Anyone who receives at least.

January 19 2022. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. Starting in January 2022 youll be able to get your previous tax returns that you filed with Credit Karma.

Robot artist Ai-Da reset while speaking to UK politicians. The change in tax law put into effect by the American Rescue Plan during the Covid requires your gross income to be reported to the IRS if it totals more than 600. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year.

Rather small business owners independent. By Tim Fitzsimons. Venmo CashApp and other third-party apps to report payments of 600 or more to the IRS.

PayPal which owns Venmo is offering similar guidance for users of its app a company spokesperson said. More than 60 million people use the Venmo app for fast safe social payments. Here are some details on what Venmo Cash App and other payment app users need to know.

You can also use the Cash App debit card to make online and in. I dont know anyone who uses Zellebut its handling 2x Venmo and Cash App. Day-to-day activity like sending your friend.

Under the prior law the. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to. Cash App is a free mobile payment platform for peer-to-peer payments between friends.

In the past few years I didnt make enough to file taxes - less than 12550 per year - so I just didnt do it but I am. And for many people in 2023 life will bring a 1099-K form to ensure certain transactions on apps like PayPal Venmo and Cash App are taxed appropriately. PayPal and Venmo TaxesTax Rules for Cash Apps and 1099-K Form Explained.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. The new cash app regulation put in place under the American Rescue Plan seems intimidating. Perhaps thats why one Twitter user seemed surprised by the platforms relative scale.

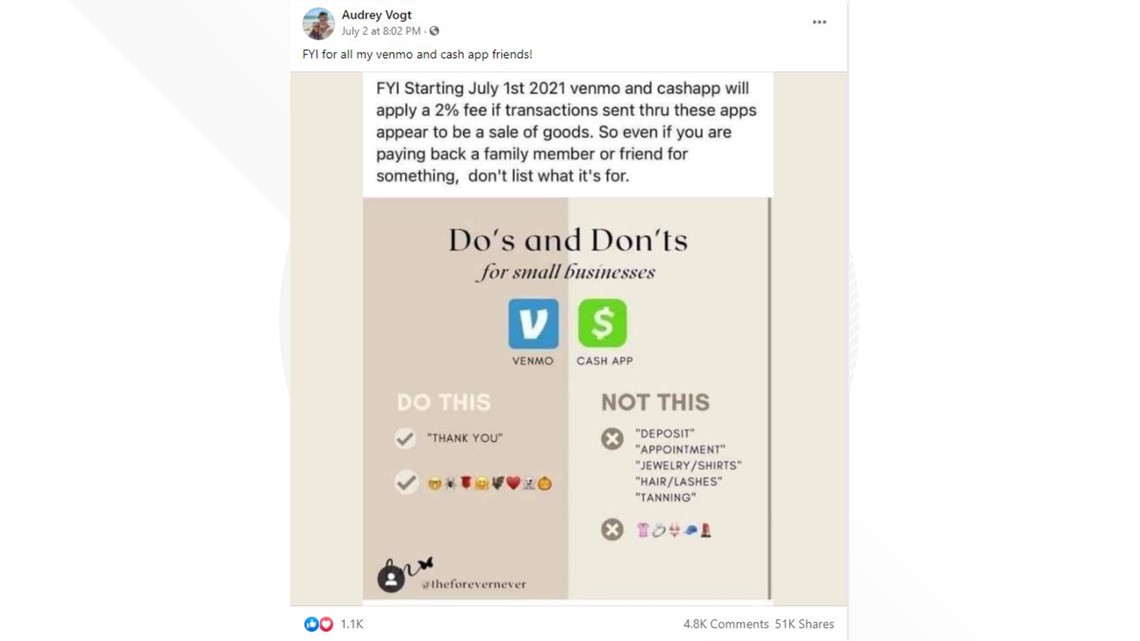

Theres a lot of misinformation surrounding new IRS cash app rules that went into effect January 1 2022 and many users worry their transactions on apps like PayPal Zelle. Its now just one. However its important to.

Cash App for example tweeted on Feb. A new tax law went into effect that requires third-party payment processors to report business transactions that meet certain new thresholds to the IRS. Previously payment processors were only required to issue a Form 1099-K if someone received 20000 in aggregate payments and 200 transactions.

This is due to. Why things changed The changes to tax laws affecting cash apps were passed. If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule.

Tax Changes Coming For Cash App Transactions

Venmo Will Have New Service Fees But You Have To Opt In Verifythis Com

What Information Does The Irs Collect From Taxpayers On Venmo Paypal Fox Business

Why Some Payments Through Cash Apps Will Need To Be Reported To The Irs Wbal Newsradio 1090 Fm 101 5

Irs Taking A Closer Look At Income Obtained From Venmo Cash App Zelle And More The Owensboro Times

New Tax Code Rules In 2022 Eyewitness News

Getting Paid On Venmo Or Cash App There S A Tax For That The Jerusalem Post

5 Things To Know About Irs Plan To Tax Cash App Transactions

Payment Apps Irs Taxes Paypal Venmo Zelle Cash App More Wiztax

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You

Paypal Venmo Cash App And Most Payment Apps To Report Payments Of 600 Or More

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

New Irs Rule Will Affect Cash App Business Transactions In 2022 Pennlive Com

Take Venmo Or Cash App Payments Will It Affect Your Taxes

Venmo Cashapp And Other Payment Apps Face New Tax Reporting Rule Cnn Business

Irs Announces Changes For Venmo Cashapp And Paypal Kcs Bookkeeping

What Is Cash App Pros Cons Features Nextadvisor With Time

Cash App Vs Venmo How They Compare Gobankingrates

Accepting Customer Payments Through Venmo Or Cash App Savvy Bird Consulting